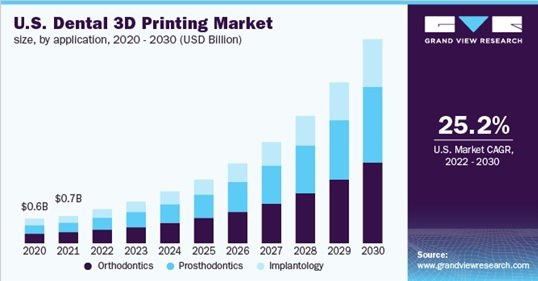

The global 3D dental printing market is projected to be valued at USD 2.0 billion in 2021, with an annual growth rate (CAGR) of 25.9 percent over the forecast period. Because of the COVID-19 pandemic, demand for dental 3D printers fell in 2020. Due to a mixture of cutting-edge 3D printing technology and a promising footprint, the 3D dental printing market has developed a strong role in today’s dental products.

Some of the factors driving the growth and surrogacy of dental 3D printers include the layout and application of improved products such as inaccessible implants, advanced manufacturing to give an aesthetic look, and shipping placement. Because of the user-friendliness and convenience of 3d printing technologies, the dentistry sector has been encouraged to create items that may fulfill the dental needs of many people. These printers will enhance output while decreasing manufacturing time. Additionally, the digitized approach will reduce procedural pain while increasing customer experience.

Other details about global 3D dental printing market

In the past few years, the medical equipment business has seen a substantial amount of market restructuring. Large manufacturers are leveraging their product portfolios through purchase and partnership methods to extend their company operations globally. The market’s competitiveness is projected to increase further as product advancements, product/service expansions, and M&A increase. For example, in December 2021, Stratasys Ltd., an American-Israeli manufacturer and a leading developer of polymer 3D printing solutions, unveiled the Stratasys Origin One Dentistry, the advanced printer in the company’s increasing line of 3D printing remedies for the dental sector.

These firms also concentrate on different engagement methods such as mergers and acquisitions and the introduction of new goods. For example, 3D Systems, a Formlabs Massachusetts-based firm, established a relationship with BEGO, a producer of implants and prosthodontics for the dental sector, in February 2020. Moreover, 3D Systems introduced the new DMP Flex 100 and DMP Dentistry 100 3D printers in June 2018, providing greater quality, adaptability, and throughput for entrance metal 3D printing and dentistry applications. They are collaborating to offer momentary and everlasting 3D printed restorations and bridges to restorative dentistry. Several major participants in the worldwide 3D dental printing market are:

- 3D Systems

- Stratasys Ltd

- Renishaw

- Roland DG

- SLM Solutions

- EnvisionTEC

- Dentsply Sirona

- Straumann

- Form Labs

- Prodways

- Planmeca

The COVID-19 epidemic has wreaked havoc on the medical device industry’s supply chain. Because of the pandemic, the number of operations conducted each year has decreased, resulting in an overall reduction in the sector. The worldwide limitations and shutdown in most nations had a detrimental influence on demand and sales of dental equipment and treatments. In addition, several equipment makers have turned their attention to combating coronavirus. Form labs, for example, announced in March 2020 that it was employing its more than 250 in-house 3D printers at its printing plant in Ohio to generate up to 150,000 COVID-19 test swabs every day. The medical equipment sector, on the other hand, is attempting to recover from the COVID-19 epidemic.

Ref:

https://www.marketsandmarkets.com/Market-Reports/dental-3d-printing-market-258228239.html